We are the Credit Union for GMB members and their families nationally. Founded by the GMB in 1999 as an alternative ethical savings and loans provider we are 100% owned and operated by GMB members.

GMB Credit Union is regulated by the FCA (Financial Conduct Authority) and the PRA (Prudential Regulator Authority). Member savings are fully protected up to £75,000 by the FSCS.

We do not invest in the money markets; instead member savings are pooled and then lent to other members thereby ensuring that money circulates solely for the mutual benefit of the GMB community. To date GMB members have borrowed over £40 million from their Credit Union

GMB Credit Union trading surpluses are returned to members as an annual dividend on savings and reinvested in the Credit Union to ensure that we deliver competitive savings and loan services for all GMB members.

The Credit Union Board and its Committees are elected by members at our AGM. We operate from our registered office based in South Manchester where we employ full time professional staff to serve members.

It's your Credit Union and if you are a GMB member you are eligible to apply for a member loan straight away, there is no need to save before borrowing. So join your Credit Union today and support our on-going campaign for greater financial inclusion through the provision of simple, secure and socially responsible financial services.

Loans

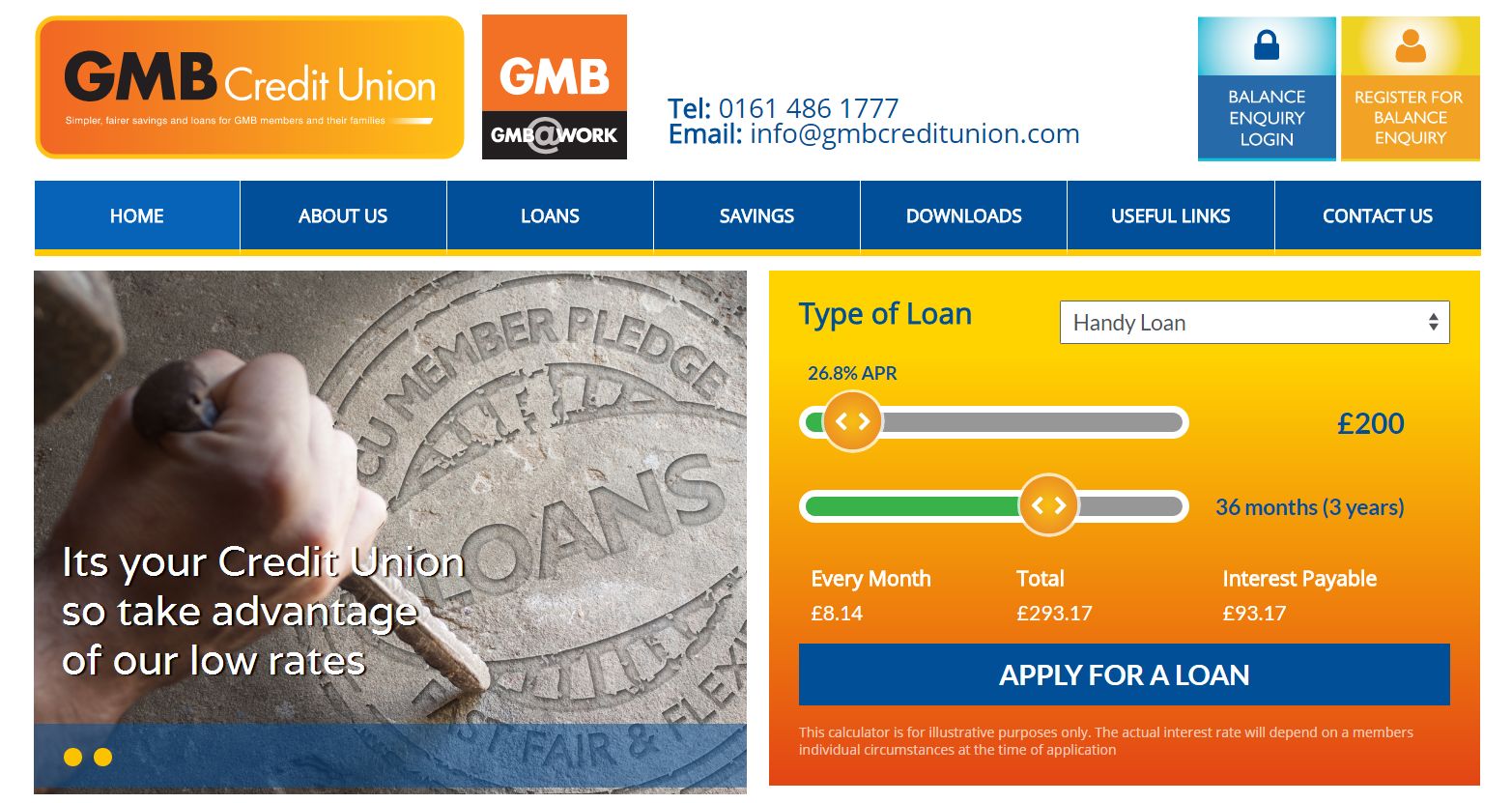

Handy Loans typical 26.8% APR

Borrow from £100 to £2,000

A cost effective short term borrowing facility

Ideal for financing those unexpected household expenses

A fair alternative to a payday loan

Member Loans from as low as 3.5% APR

Borrow £1,500 to £15,000

Very competitive loan rates

Repayment up to five years, seven years in certain circumstances

Ideal for holidays, cars, home improvement, debt consolidation

Our price promise means 'We'll beat' any like for like offer made by another loan provider, contact us for more details

Members can apply for an upfront two month repayment break

Save Secure Loan typical 3.0% APR

Borrow £5,000 to £15,000

Fully secured by members savings

No credit reference checks required. Market leading interest rates

Existing and new GMB members can apply immediately

Loan applications are consider on an individual basis and interest rates will depend on individual circumstances and the loan amount requested.

Loans are assessed on a member's ability to repay.

We may request additional supporting information and search and share credit information with credit reference agencies.

Members must hold or open a Credit Union member savings account and save an agreed amount; minimum £5.00pm; while repaying their loans.

SAVINGS

Member Savings Account

This is an easy access savings account which all members open when joining the credit union.

A flexible way to save whatever you prefer weekly or monthly

Save by direct debit, standing order or send us a cheque

Withdrawals from savings are transferred direct by BACS to your bank or by cheque on your telephone or email instructions

Junior Savings Account

Save for your children or grandchildren

This account will be in the child's name but under adult control until 18

Deposit lump sums or save on a regular basis by direct debit, standing order

We will gift £5 to each Junior account when activated to encourage savings

Christmas Club

Budget for the festive season by saving regularly over 11 months

One withdrawal from the Christmas Club to your bank account is made annually in the first week of December

Your Christmas Club will automatically restart in January of the following year unless you advise us otherwise

Credit Union savings are fully protected by the Financial Services Compensation Scheme up to £75,000. A competitive dividend recommended by the credit union Board and approved at the AGM is paid annually on Member and Junior savings accounts. Stay in touch with your savings through our online balance enquiry or request a statement as required.